Can HMRC Track Vinted Sales in 2026? What You Need to Know

January 8, 2026

Companies House Identity Verification Penalty: What Happens If You Don’t Verify?

January 21, 2026What is an Entity in Business? A Complete Guide for eCommerce Sellers

An entity in business is the very first thing every ecommerce entrepreneur must define before shipping their first parcel. In the simplest terms, a business entity is a legal structure that defines how your company is viewed by the law and tax authorities. For online sellers, this choice determines whether you are personally responsible for a customer’s lawsuit or if your business stands as its own “legal person” to protect your personal savings.

The Two Sides of a Business Entity

When we talk about an entity in business, we are usually looking at it through two lenses:

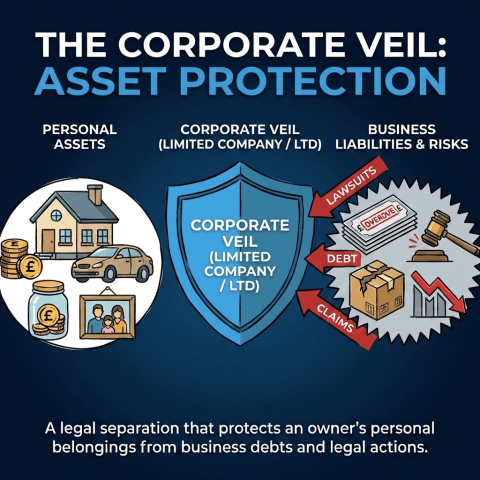

- The Legal Lens: Is the business a separate legal “person”? If it is, it can sign contracts, take out loans, and be sued without directly involving the owner’s personal assets (like your home or car).

- The Accounting Lens: Even if you don’t form a separate legal company, the “economic entity assumption” requires you to keep your business transactions strictly separate from your personal grocery shopping.

Common Business Entities for eCommerce

Whether you are selling on Shopify, Amazon FBA, or TikTok Shop, you will likely fall into one of these three categories:

- Sole Proprietorship / Sole Trader: This is the default. You and the business are legally one and the same. It’s easy to set up but carries “unlimited liability”—if the business owes money, you owe money.

- Limited Liability Company (LLC) / Limited Company (Ltd): This creates a separate entity in business. It protects your personal assets and often provides more professional credibility with wholesalers.

- Partnerships: Ideal if you are launching a store with a co-founder. You share the profits—and the risks.

| Feature | Sole Trader / Proprietor | LLC / Limited Company |

| Setup Ease | Very Easy | Moderate (Registration required) |

| Liability | Unlimited (Personal risk) | Limited (Business risk only) |

| Taxation | Personal Income Tax | Corporation Tax / Dividends |

| Privacy | High (Private records) | Lower (Public filings) |

Why the “Entity” Matters More in 2026

The ecommerce landscape has changed significantly as we enter 2026. Tax authorities, such as HMRC in the UK and the IRS in the US, have moved toward deeper digital integration.

Under the 2026 Making Tax Digital (MTD) and Companies House updates, “informal” selling is under higher scrutiny. Online marketplaces now share data directly with tax offices. If you haven’t formally declared your entity in business, you may face automatic penalties. Furthermore, new identity verification rules for company directors mean that even “small” entities must maintain high standards of transparency.

Liability: The Hidden Risk of “Going Viral”

In the age of social commerce, a product can go viral overnight. While this is great for sales, it increases your “product liability.” If a customer is injured by a product you sold, having a separate entity in business like an LLC or Ltd company ensures that a legal claim doesn’t result in you losing your personal home. This “corporate veil” is the primary reason why scaling sellers move away from sole proprietorships.

How to Choose Your Structure

If you are just testing a hobby, starting as a sole trader is cost-effective. However, once your turnover hits a consistent level—typically around the VAT/Sales Tax threshold—switching to a formal entity in business often saves you money through tax efficiencies and provides the protection you need to sleep soundly at night.