HMRC Digital Platform Reporting Deadline: Critical January 2026 Rules for UK Online Sellers

December 18, 2025

Can HMRC Track Vinted Sales in 2026? What You Need to Know

January 8, 2026As we approach the end of 2025, TikTok Shop UK sellers face a critical compliance deadline that could halt their business overnight. If you haven’t yet completed your TikTok Shop UK MRDP annual confirmation, you are officially in the “danger zone.”

With today being December 31, 2025, any seller who has not verified their tax details in the Seller Center will find their payouts blocked starting tomorrow, January 1, 2026. This isn’t a platform glitch or a temporary bug; it is a mandatory requirement under the UK Model Reporting Rules for Digital Platforms (MRDP).

HMRC now requires all digital marketplaces to report seller income with 100% accuracy. To comply, TikTok has shifted the burden of data integrity onto the seller. Here is everything you need to do in the next few hours to keep your shop running.

What is the 2026 MRDP Requirement?

The UK MRDP rules, which became a standard part of the e-commerce landscape in 2024, have reached a new level of enforcement for the 2025/2026 cycle. TikTok Shop is now legally obligated to report your total sales, VAT status, and National Insurance Number (NINO) to HMRC by January 31, 2026, for the previous calendar year.

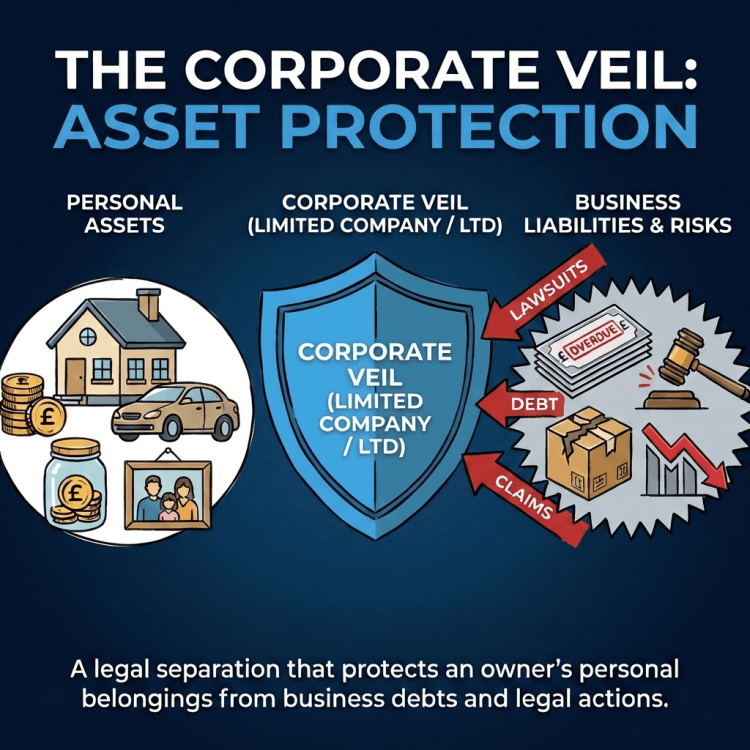

However, TikTok cannot report data it hasn’t verified. The TikTok Shop UK MRDP annual confirmation is your digital signature, testifying that the business address, tax ID, and legal entity details on file are current. If you have moved house, changed your business structure from a sole trader to a limited company, or recently registered for VAT, this confirmation is the only way to ensure HMRC receives the correct information.

The Consequences of Missing the Deadline

The primary risk for non-compliance is the immediate suspension of payouts.

- Frozen Funds: Starting January 1, 2026, your “Settled” and “Upcoming” funds will be held in escrow by TikTok.

- Account Health Impact: Frequent delays in tax verification can lead to “Account Health” points being deducted, which may limit your visibility in the TikTok algorithm.

- HMRC Nudge Letters: If TikTok reports outdated information and it doesn’t match your Self Assessment or Corporation Tax filings, you are significantly more likely to receive a “nudge letter” or a formal inquiry from HMRC.

How to Complete Your TikTok Shop UK MRDP Annual Confirmation

Don’t wait for the midnight countdown. Follow these steps immediately via the Desktop Seller Center (mobile functionality can be limited for tax forms):

- Navigate to Finance: Log in and find the Finance tab on the left-hand sidebar.

- Access the Invoice Center: Click on Invoice Center and look for the Tax Information header.

- Find the MRDP Section: Click on the sub-tab labeled “For MRDP”.

- Review and Edit: Check that your Business Address, NINO/UTR, and VAT registration match your current legal status.

- Submit Confirmation: Click the “Confirm” button. You should receive an instant status update showing “Verified” or “Submitted.”

Note for 2026: If you are a high-volume seller (over 2,000 transactions), TikTok may require additional “Due Diligence” documentation. Ensure your uploads are clear and match your Companies House or HMRC records exactly.