How the Latest Inflation Reports Affect Your Ecommerce Business (and What to Do Now)

August 21, 2025

How Much Money to Start an Amazon Business in the UK? (Accountant’s Breakdown)

September 4, 2025Updated for 2025/26: VAT threshold, dividend allowance, employer NI changes, Companies House ID checks and MTD for ITSA.

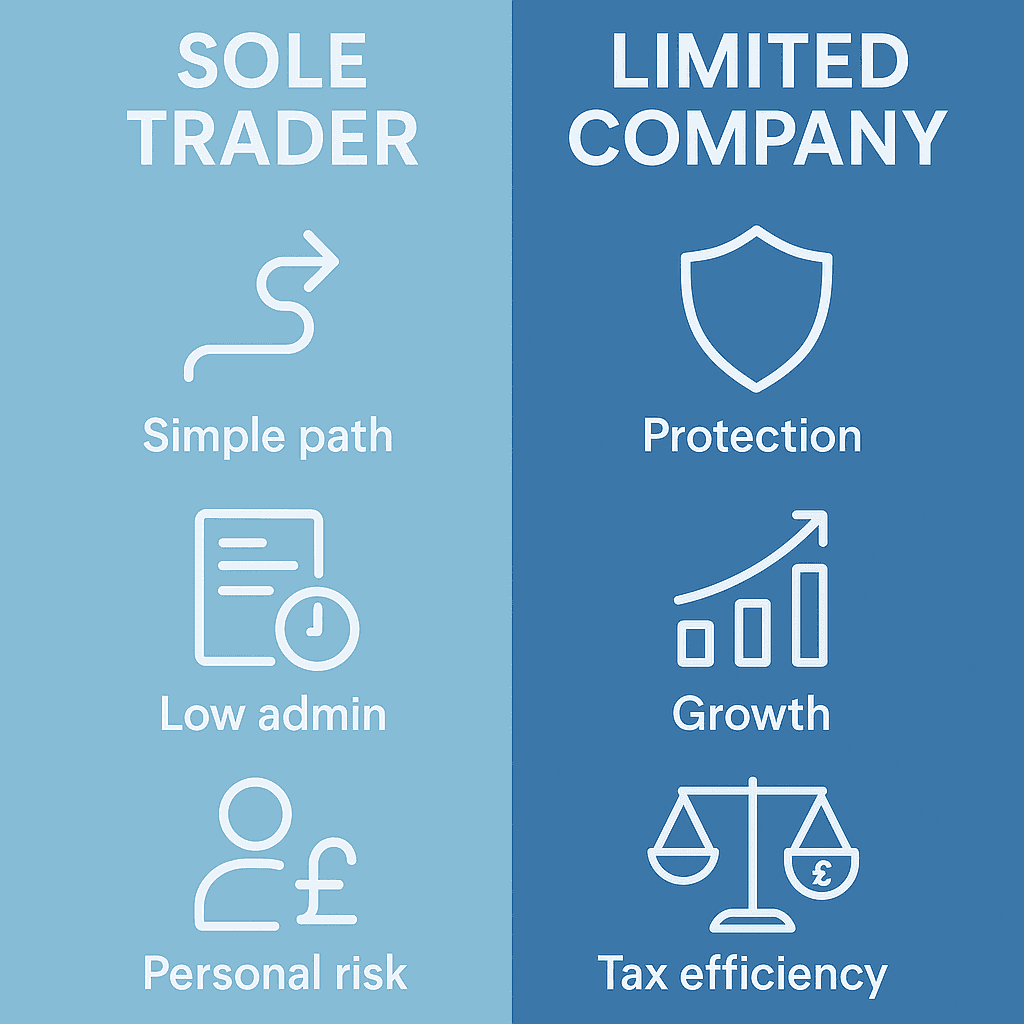

Sole trader vs limited company UK e-commerce is the decision that most affects your tax bill, admin load and personal risk when selling via Shopify, Amazon, Etsy, eBay or your own site.

Sole trader vs limited company UK e-commerce: the quick answer

- Choose Sole Trader if you’re testing an idea, expect modest profits in year one, want the simplest setup and don’t need investors. Costs and admin are lowest.

- Choose Limited Company if you expect consistent profits, want limited liability, plan to pay yourself salary + dividends, care about brand credibility or may raise finance.

How the structures compare in 2025/26

1) Liability & risk

Sole trader: you are the business — personal assets are at risk for business debts. Limited company: separate legal entity; liability is generally limited to share capital.

2) Tax headlines (2025/26)

- Sole trader: Income Tax bands in England, Wales and Northern Ireland remain frozen with a £12,570 personal allowance; Scottish bands differ. Class 4 NI is 6% between £12,570–£50,270 and 2% above that. Class 2 is not compulsory above the Small Profits Threshold; those below it can usually pay voluntary Class 2 to protect State Pension. HMRC NI for the self-employed; UK rates 2025/26.

- Limited company: Corporation Tax: 19% (≤£50k), 25% (≥£250k) with marginal relief between. Dividends are taxed at 8.75% / 33.75% / 39.35% with a £500 dividend allowance. CT rates; HMRC dividends.

3) Paying yourself

Sole trader: you draw profits (no dividends). Company owner-director: many take a small salary via PAYE plus dividends. From 6 April 2025 the employer’s NI rate is 15% and the secondary threshold is £5,000, so model the total cost before choosing a salary level. Employers’ rates/thresholds; Policy note.

4) Admin & privacy

Sole trader: simpler records and annual Self Assessment. Limited company: accounts, CT600, payroll, dividend paperwork and public filings. Identity verification becomes mandatory for directors/PSCs starting 18 November 2025 with a 12-month rollout. Companies House announcement.

5) VAT for e-commerce

Whatever you choose, register when rolling 12-month taxable turnover exceeds £90,000. Consider voluntary registration to reclaim input VAT on stock, shipping and platform fees. VAT threshold £90,000.

6) Marketplace data-sharing (Amazon/eBay/Etsy/Vinted)

From 1 January 2024, platforms report seller details and income to HMRC under the UK’s digital platform reporting rules — expect platform-generated summaries and keep clean records. HMRC guidance.

2025/26 snapshot for online sellers

- Income Tax bands (E/W/NI) and £12,570 personal allowance remain; Scotland has different bands. HMRC bands; Scottish rates.

- Self-employed NI: Class 4 at 6%/2%; voluntary Class 2 if below the SPT. HMRC NI.

- Corporation Tax: 19% small profits, 25% main, marginal relief between. Marginal relief.

- MTD for Income Tax (ITSA): mandatory from 6 April 2026 for income > £50k, then from 6 April 2027 for > £30k. Gov.uk update; MTD campaign site.

- Companies House: ID verification begins 18 Nov 2025 with phased rollout. Announcement.

E-commerce-specific considerations

- Stock & cash flow: companies can retain profits at CT rates to fund inventory; sole traders are taxed on all profits each year.

- VAT complexity: imports, EU IOSS/OSS and marketplace fees can swing the decision — model the cash impact.

- Perception & growth: brands, wholesalers and investors often prefer dealing with limited companies.

Rule-of-thumb (run the numbers!)

Low profits (e.g., under ~£30k): sole trader is often simplest and cost-effective after fees. Medium to higher profits (e.g., £40k–£100k+): a company usually wins once you factor Corporation Tax vs Income Tax/NI, dividend extraction and the 15% employer NI from April 2025. Always model both routes for your expected profit, salary/dividend mix and VAT position.

Conclusion

If you’re trialling a store or side-hustle, sole trader keeps costs and admin light. As profits and risk grow, a limited company typically offers better protection and more flexible tax planning — especially when reinvesting in stock and marketing. Keep an eye on VAT threshold, MTD start dates and Companies House changes as you scale. For tailored numbers, ask us to model sole trader vs limited company UK e-commerce using your forecast.