Do You Need to Report TikTok Shop Earnings in the UK? Small Sales Tax Guide (2025)

August 7, 2025

How the Latest Inflation Reports Affect Your Ecommerce Business (and What to Do Now)

August 21, 2025Shopify vs Amazon fees: the UK accounting view on keeping more profit

Shopify vs Amazon fees can be the difference between a healthy margin and a loss. For many UK sellers, moving some sales to Shopify reduces per-order fees and increases net profit. You can also run both channels for a short experiment to calculate risk before committing. ✅

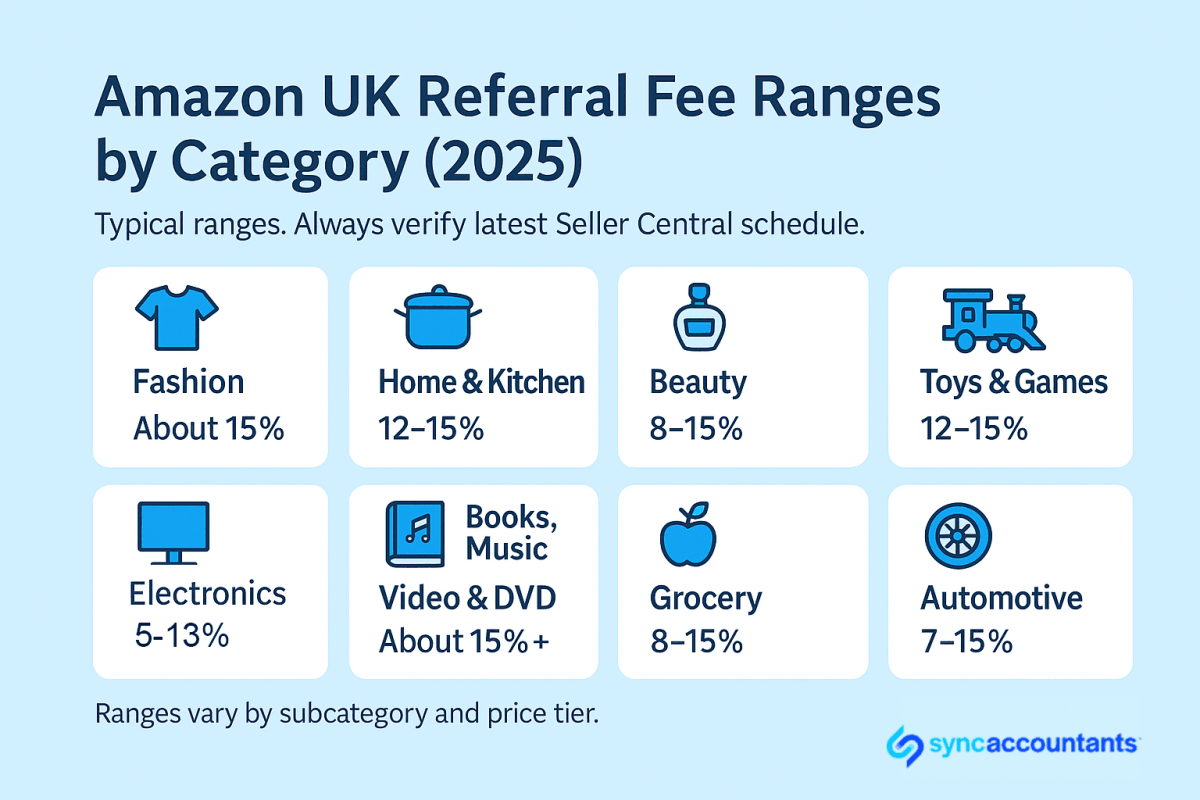

What UK sellers actually pay on Amazon in 2025

Amazon charges a monthly subscription for Professional accounts and a referral fee on each sale. The Professional plan is £25 per month excluding VAT, and most referral fees sit between 8% and 15% by category.

Beyond referral fees, some sellers also use FBA where fulfilment, storage and inbound placement can add costs. Amazon’s 2025 EU update indicated stability in overall fee types for this year, so planning around the 2024 referral table remains reasonable.

What UK sellers pay on Shopify in 2025

Shopify costs are primarily subscription and payment processing. Current UK pricing shows Basic £25 per month pay-monthly or £19 per month billed yearly, Grow £65 or £49, and Advanced £344 or £259. Using Shopify Payments, card rates start from 2% + 25p on Basic, 1.7% + 25p on Grow, and 1.5% + 25p on Advanced. If you use an external gateway, Shopify charges an additional transaction fee of 2%, 1%, or 0.6% respectively.

There was also a 2025 change where orders using gift cards or store credit can incur third-party transaction fees on the credited amount for newer stores. Review your billing settings if you rely on store credit.

Profit comparison: quick maths you can trust 🧮

Let us compare typical orders to see how Shopify vs Amazon fees affect contribution margin.

- Average order value £40, same product and shipping method on both channels

- Amazon referral at 15% equals £6.00

- Shopify Payments on Basic at 2% + £0.25 equals £1.05

In this scenario the Shopify fee is £4.95 lower per order. If your Shopify fixed stack for the month is, say, £40 for subscription plus a few essential apps, you break even after roughly 9 orders in the month. After that, each additional order saves about £4.95 versus an Amazon-only strategy.

Different categories have different Amazon referral rates, so the breakeven shifts:

- At 8% referral, difference is about £2.15 per order, breakeven ~19 orders

- At 12%, difference ~£3.75, breakeven ~11 orders

- At 15%, difference ~£4.95, breakeven ~9 orders

These are clean comparisons for fees only. You still need to budget for marketing, shipping, returns, packaging and customer service on both channels.

How to run a 60-day dual-channel experiment to calculate risk 🧪

Use a limited test to quantify your Shopify vs Amazon fees advantage without betting the farm.

- Set up tracking and SKUs

Create identical SKUs across channels with channel-specific price lists if needed. Add UTM tags to Shopify ads and note Amazon ad spend separately in a simple sheet. - Define the test window and targets

Choose a 60-day window that avoids major seasonality. Set targets for orders, contribution margin per order and cash generated after fulfilment. - Price and promos

Start with the same retail price on both channels, then test small Shopify incentives like free shipping thresholds or bundles. Track impact on conversion and margin. - Accounting structure from day one

- Create separate nominal codes for Amazon fees, Amazon advertising, FBA fees, Shopify subscription, Shopify Payments fees and external gateway fees.

- Reconcile Amazon settlements and Shopify Payouts to bank feeds weekly.

- Save invoices and settlement reports digitally for MTD and audit readiness.

- VAT setup and documentation

- Ensure your VAT registration and rates are configured in Amazon and Shopify correctly. Follow HMRC guidance for online marketplaces and direct sales, as obligations differ by where goods are located and who facilitates the sale.

- If you sell via Amazon Business, consider Amazon’s VAT Calculation Service for B2B invoices, but remember you remain responsible for accuracy.

- Measure contribution margin, not just revenue

Use this per order formula:

Contribution margin = Selling price − COGS − channel fees − shipping and packaging − ad spend attributed to that order.

Report weekly by channel. The channel with higher sustained contribution margin and stable conversion should earn more of your inventory. - Scale with guardrails

If Shopify proves consistently more profitable, move incremental traffic there and reserve Amazon for discovery, bestsellers and new product validation. Keep a minimum Amazon presence to maintain rank and reviews.

Where Shopify shines and where Amazon still wins ⚖️

Shopify vs Amazon fees often favours Shopify on per-order cost, especially above modest monthly order volumes. Shopify gives you first-party data, email ownership and full control over the checkout, which compounds long-term value.

Amazon still wins on in-platform demand and trust. You may pay more per order, yet the marketplace can deliver incremental customers you might not reach via ads. If you already pay for Amazon’s Professional plan, ensure your listings, images and ads are optimised so you do not overpay for traffic that could convert cheaper on Shopify.

UK VAT and compliance notes for multichannel sellers

- For UK-established sellers shipping goods from the UK, you charge UK VAT on both channels once registered. Review HMRC marketplace guidance carefully, since responsibilities differ for overseas sellers and for goods located outside the UK.

- Shopify Payments fees and payout timing affect cash flow. Reconcile payouts to keep VAT boxes accurate, especially if you operate multi-currency or sell to EU markets.

- Amazon offers VAT resources and tools, yet they do not replace proper bookkeeping or UK compliance. Keep digital records for MTD and archive settlement files monthly.

Action plan: test both, then allocate spend with confidence

Run the 60-day test, review contribution margin by channel, and formalise your accounting structure. If the experiment validates that Shopify vs Amazon fees meaningfully improve margins, shift budget to Shopify while keeping a calibrated Amazon presence for reach. Your books will show the answer within two months.