Shopify vs Amazon Fees: 7 Profit Boosts for UK Sellers

August 14, 2025

Sole trader vs limited company UK e-commerce (2025/26): what’s best for your online shop?

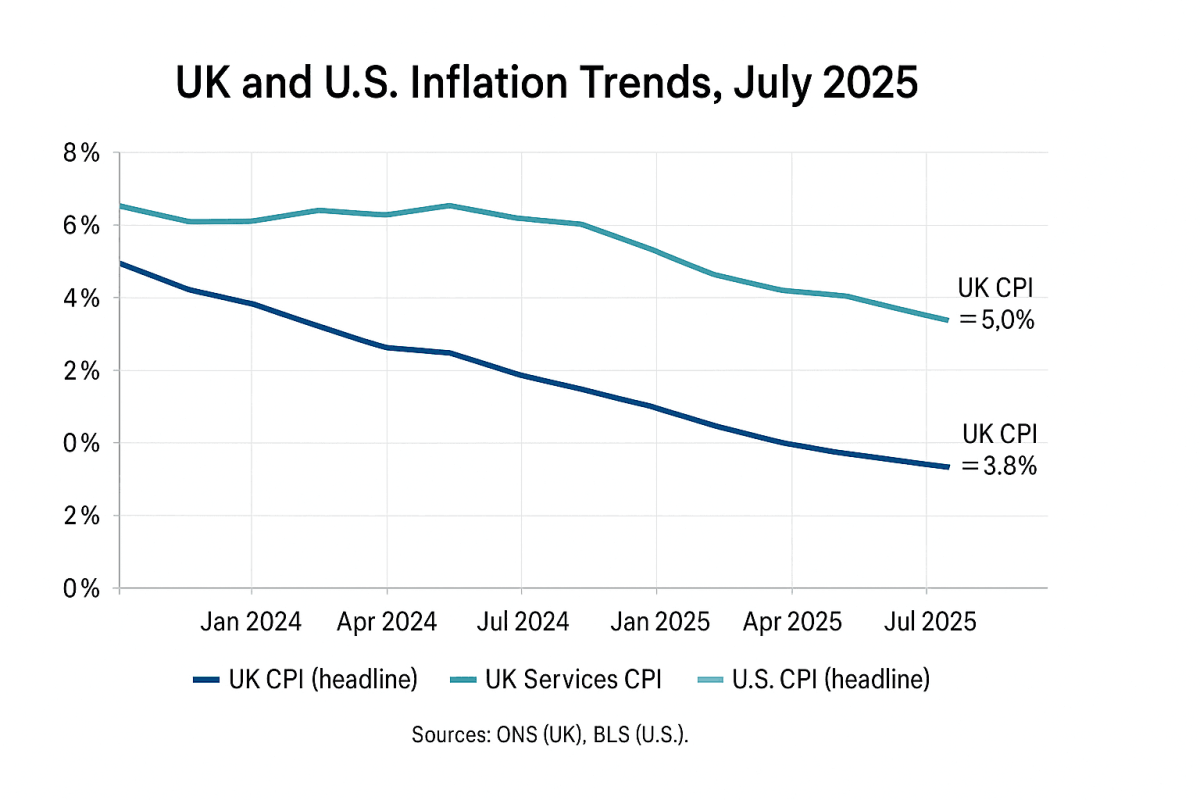

August 28, 2025Inflation is cooling in some places and re-accelerating in others—and that mixed picture matters for your online margins, pricing, and cash flow. In July 2025, UK headline CPI rose to 3.8% year-on-year, with airfare-driven services costs nudging the rate higher. Meanwhile, U.S. CPI held steady at 2.7% year-on-year, with core inflation at 3.1%.

What the numbers signal for ecommerce

UK inflation’s latest uptick was heavily influenced by a sharp jump in airfares, highlighting ongoing services-price volatility that can spill into delivery, travel-related logistics, and advertising/travel categories. For July, the ONS noted airfares rose 30.2% month-on-month, the biggest July increase since 2001—another reminder that costs can swing quickly and compress ecommerce margins if you’re not pricing and forecasting dynamically.

At the same time, digital prices keep behaving differently. Adobe’s Digital Price Index shows U.S. ecommerce prices have fallen for 33 straight months (-2.01% YoY in May 2025), reflecting intense competition and deal-seeking behavior online. That can make raising prices harder even as your costs fluctuate.

UK-specific ecommerce data from Adobe’s H1 2025 report reinforces that caution: shoppers are trading down to cheaper SKUs across major categories, BNPL growth has slowed, and online spend for Jan–Jun reached £49.7bn (up 1.6% YoY)—modest growth that relies heavily on promotions and sharp price points.

How inflation feeds through your P&L

- Cost of goods sold (COGS): Supplier price changes and currency moves can whipsaw landed costs.

- Fulfilment & logistics: Services-driven inflation (e.g., air/road transport, fuel) can raise shipping and returns processing costs.

- Marketing & discounts: With online prices trending lower, expect continued promotion pressure to maintain conversion and AOV.

- Payments & BNPL: Slowing BNPL growth can affect conversion mix and fees—watch take-rates and approval rates closely.

Five accountant-approved moves to protect margin now

- Run SKU-level margin waterfalls weekly. Update COGS for new freight/fuel surcharges, revise contribution margins, and flag loss-making variants fast.

- Test micro-prices, not blanket hikes. Use A/B tests on sensitive ranges (e.g., £24.99 vs £25.49) and pair small increases with perceived-value boosters (bundles, extended returns).

- Scenario-plan cash flow (13-week rolling). Model “base / higher-cost / promo-heavy” cases so you know reorder points, payroll coverage, and marketing runway if rates or input costs jump.

- Negotiate terms and spreads. Push suppliers for net-terms extensions and rate-card reviews; consolidate carriers to secure volume tiers. Consider simple FX hedges if you buy in USD/EUR.

- Discount with discipline. Tie promotions to category events (e.g., Prime-style periods) where elasticity is highest and shoppers actively seek deals.

Signals your finance team should watch monthly

- UK CPI headline & services components (air/transport, housing): informs fulfilment and overhead assumptions.

- U.S. CPI headline & core if you buy stock in USD or sell into the U.S. market.

- Adobe Digital Price/ Economy Index: benchmarks category-level online price trends and the promotional environment.

Bottom line

Expect continued margin squeeze from services-linked costs while online price competition stays fierce. Pair granular margin tracking with targeted pricing tests and disciplined promotions. If you’d like help building a rolling cash-flow model and SKU-level pricing playbook, an ecommerce-savvy accountant can implement this in your finance stack quickly.