Amazon’s Potential Acquisition of TikTok: A Game-Changer for UK eCommerce?

May 7, 2025

TikTok Shop’s European Expansion: What UK Sellers Need to Know About VAT

May 22, 2025Selling on TikTok Shop UK in 2025 offers immense opportunities, but it also brings specific tax obligations. Understanding these responsibilities is crucial to ensure compliance and avoid potential penalties. This comprehensive guide will walk you through the essential tax considerations for TikTok Shop sellers in the UK.

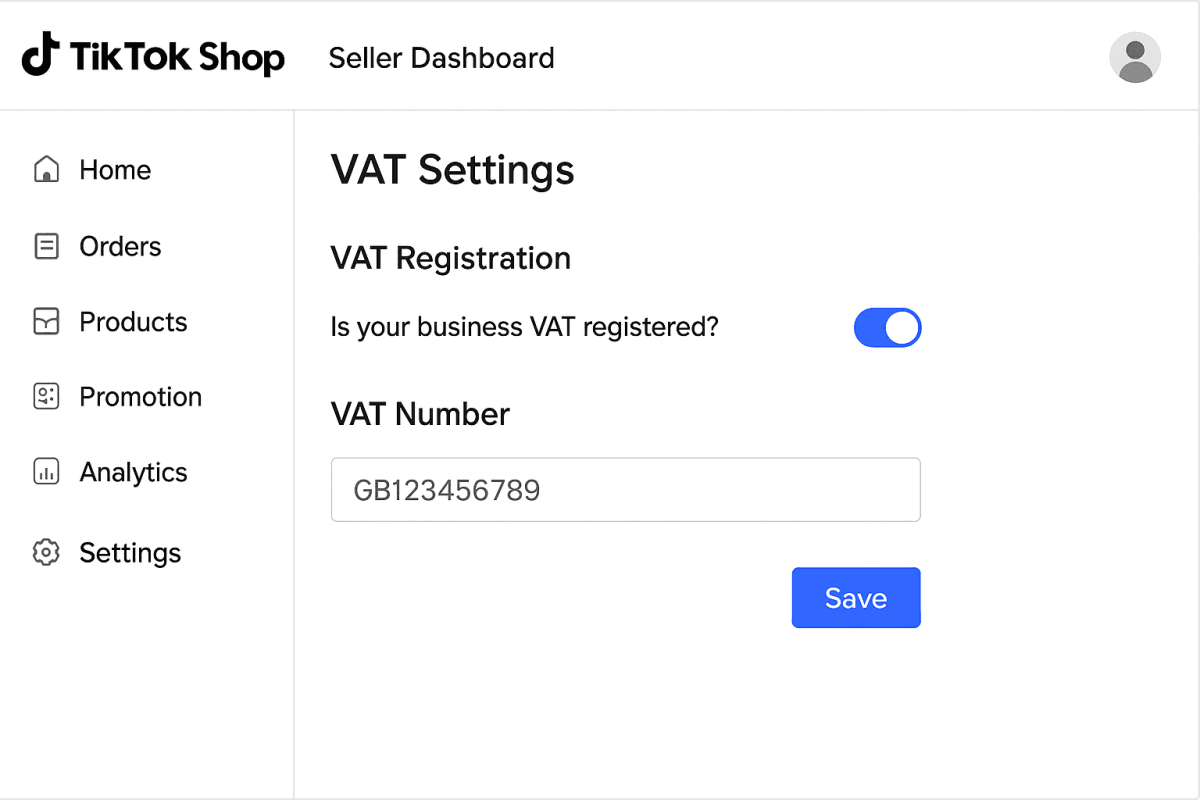

🧾 Value Added Tax (VAT)

VAT Registration Threshold

If your taxable turnover exceeds £90,000 in a 12-month period, you’re required to register for VAT with HM Revenue and Customs (HMRC). Even if your turnover is below this threshold, voluntary registration can be beneficial, allowing you to reclaim VAT on business expenses.

Charging and Collecting VAT

Once registered, you must:

- Charge the standard VAT rate of 20% on applicable goods and services.

- Display VAT-inclusive prices on your TikTok Shop listings.

- Provide VAT-compliant invoices to customers.

TikTok Shop offers tools to help sellers include VAT in their product prices, ensuring transparency for buyers.

VAT Returns and Record-Keeping

VAT-registered businesses must submit quarterly VAT returns to HMRC, detailing:

- Total sales and purchases.

- Amount of VAT owed or reclaimable.

Maintaining accurate records of all transactions is essential for compliance and can be facilitated by accounting software integrated with TikTok Shop.

💼 Income Tax and Corporation Tax

Sole Traders

If you operate as a sole trader:

- Profits are subject to Income Tax.

- You must file a Self Assessment tax return annually.

- Keep detailed records of income and allowable expenses to accurately calculate taxable profits.

Limited Companies

Operating through a limited company involves:

- Paying Corporation Tax on company profits.

- Filing annual Company Tax Returns with HMRC.

- Directors may also be subject to Income Tax on salaries and dividends received from the company.

The current Corporation Tax rate is 19% for profits up to £50,000 and 25% for profits over £250,000.

🛃 Import VAT and Customs Duties

If you import goods into the UK for sale on TikTok Shop:

- Import VAT is typically charged at 20% on the value of the goods.

- Customs duties may apply, depending on the type and origin of the goods.

- VAT-registered businesses can usually reclaim import VAT, reducing overall costs.

Proper documentation and accurate declarations are essential to navigate import taxes effectively.

📚 Compliance and Record-Keeping

To stay compliant with UK tax laws:

- Maintain detailed records of all sales, purchases, and expenses.

- Use accounting software compatible with TikTok Shop to streamline bookkeeping.

- Adhere to Making Tax Digital (MTD) requirements if applicable.

- Meet all filing deadlines for VAT returns, Self Assessments, and Corporation Tax returns.

Accurate record-keeping not only ensures compliance but also provides valuable insights into your business performance.

✅ Conclusion

Understanding and managing your tax obligations is a critical aspect of running a successful TikTok Shop in the UK. By staying informed about VAT, income tax, and compliance requirements, you can focus on growing your business with confidence. Consider consulting with a professional accountant to tailor tax strategies to your specific circumstances.